For those who didn’t catch, here’s part 1.

Disclaimer: I AM NOT A LAWYER! I AM NOT A CERTIFIED FINANCIAL PLANNER! I AM NOT A TAX ATTORNEY! WHATEVER I INFER FROM THIS DOCUMENT REFERENCED IS OF MY OWN OPINION AND SHOULD NOT BE CONSTITUTED FOR LEGAL OR INVESTMENT ADVICE!

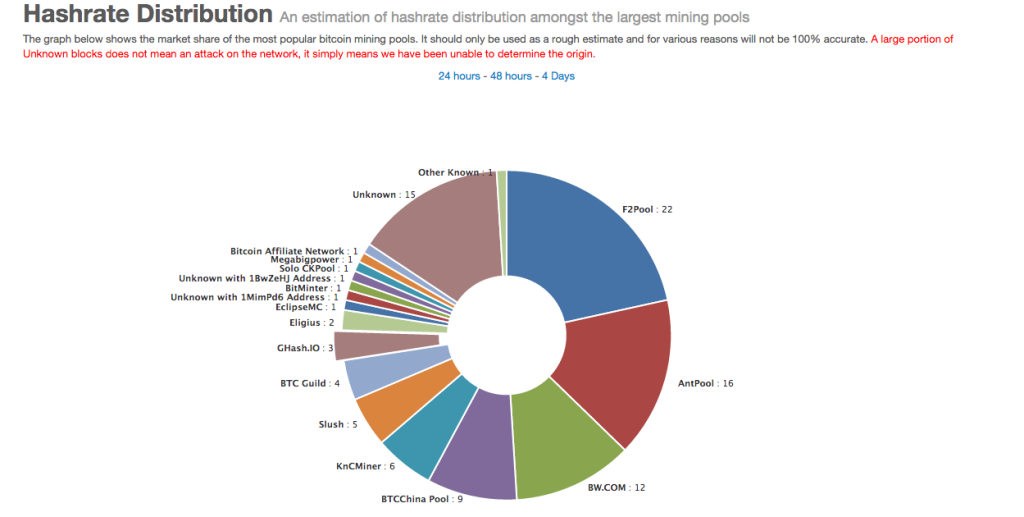

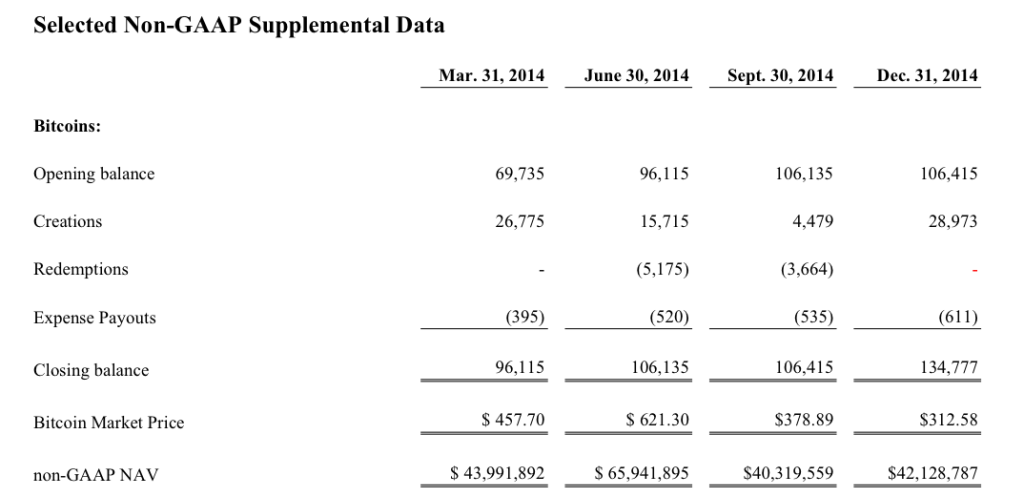

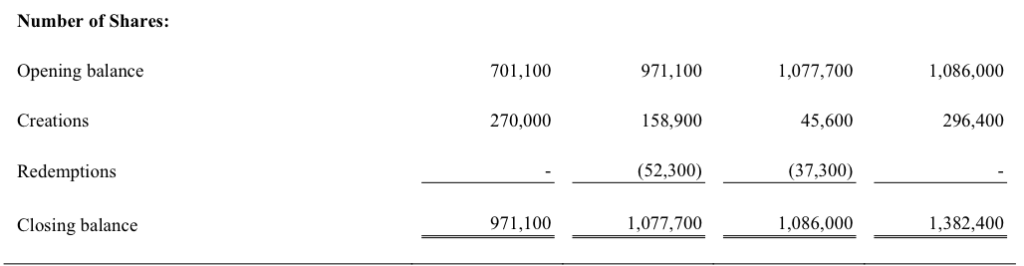

I’ve continued onward from page 55 (where we last left off) and have only seen mention of continued factors which could significantly impact bitcoin adoption in the future – and ultimately cause a signifiant impact to the NAV of the Trust. However don’t be alarmed. These are expected concerns: Concerns such as the block halving events that occur as we continue to mine towards 21 million coins – the entire exhausted supply of generated bitcoins for use for instance. Another example commonly cited was the incidence of a forking event from miners disagreeing with which version of bitcoin to relay transactions onto. (not Different software, but different versions of the bitcoin protocol itself – i.e.: Gavin Anderseen deciding to expand the block size limit to 100 MB instead of just 1MB (perhaps for better industrial use cases or data access propagation reasons). Imagine that many of the miners don’t care so they don’t bother upgrading, or they perhaps disagree, or perhaps the pool operator GHash.io doesn’t care about upgrading their Core Bitcoin Software and they control 18% of the mining hashrate. All it takes is a sizeable group to cause a ‘fork’ in the blockchain – for the uninformed a ‘fork’ in software is a divergence of data – in terms of forking in Bitcoin: some miners would be mining on one blockchain, others would mine onto the forked different chain. Blockchain forking is a major problem because transactions on the rejected fork can potentially become invalid once a software correction occurs.)

Before getting back on topic, let’s ponder on page 60 for a minute. I just found myself exclaiming: “Did I JUST SEE GBTC LAY OUT THE CASE FOR ALT-COINS?” If a situation presents itself such that there is a split amongst consensus, this split postulates a proposed alt-coin or alt-chain to facilitate a mechanism which provides new-found consensus. Okay showerthought complete, moving forward:

Page 64 has my heart torn. Middle way through:

To calculate the reference rate, trade data is cleansed and compiled in such a manner as to algorithmically reduce the impact of anomalistic or manipulative trading. This is accomplished by adjusting the weight of each data input based on price deviation relative to the observable set of data for the relevant trading venue, as well as recent and long-term trading volume at each venue relative to the observable set for the relevant trading venues

Fair Enough. Except that immediately after they also mention:

TradeBlock may change this weighting algorithm at any time at its discretion.

I’m not sure how I could feel about the sentiment, following that sentence. 2 points for honesty, but -2 points for “EZ market manipulation much???” potential. Although it is in the better interest of the investors to divulge this knowledge, it is CERTAINLY within the better interests of GBTC Sponsor, Greyscale LLC to adjust the price discovery algorithm as often and as profitably as possible. Again, I understand they don’t have to really tell us this, and that they’re simply being transparent for which I applaud Gary Silbert, but at the same time, I’m hoping that they determine a convertibility strategy as soon as possible to allow users to convert coins into shares and conversely convert shares back into coins. (Ultimately it is against GreyScale’s better interests to facilitate a conversion market for redeeming because the young market would be subject to abuse and manipulation. Placing limits on convertibility will allow Second Market (which serves as the Distributor, Marketer, Initial Purchaser, and sole Authorized Participant of the Trust – fun fact, on the bottom of page 65: Barry Silbert, the founder of SecondMarket and an officer of the Sponsor, indirectly owns approximately 1.5% of TradeBlock’s voting equity and acts as an advisor to that company.) to mitigate potential issues related to price manipulation abuse – 2 more points for Grayscale’s attempt towards integrity via transparency).

According to page 65, GBTC is looking to secure its place as a grantor trust, but that as of this time, there is no guarantee that the IRS will grant this request and consider them as such. If you did not yet click the link above, a grantor trust, simply means that GBTC would not be subject to Income Tax liability directly: The individual shareholders themselves would be subject to the impacted gains and losses and their associated tax liabilities.

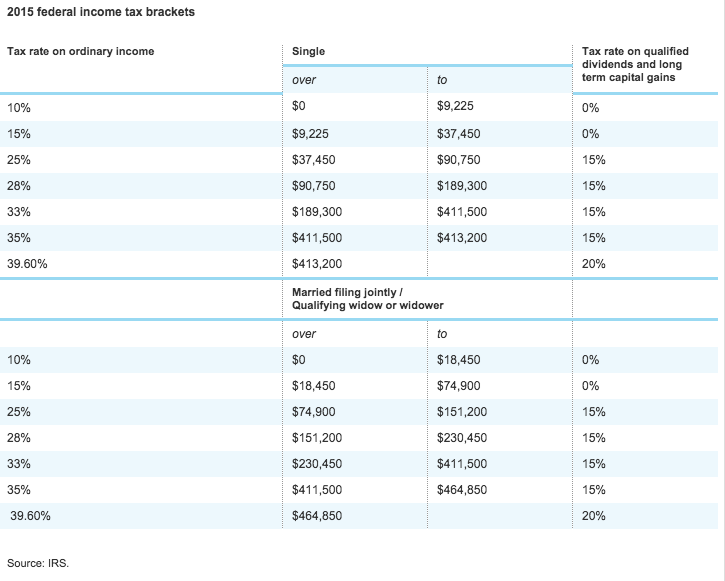

See pages 67-68 for what I would reasonably deem as ‘fair game’ Tax Advice (Which again, by the way, I am not qualified to provide). My own comprehension of past readings postulates that Bitcoin is a commodity. That is, it is a portion of ‘personal property’ that is currently subject to short term or long terms capital gains taxes if held as a store of value – however bitcoin can also be received immediately and considered taxable income, the moment it is sold for cash. If you happen to earn more than 200,000 USD per year AGI, there is an additional 3.8 % tax added. Also, if your expenses from the trust exceed 2% of your total adjusted gross income, those may also be taken as itemized deductions.

Though I’m paraphrasing above, my 2nd pass through those pages found a rather clear snippet:

In the case of Shares acquired for cash, the Shareholder’s initial tax basis in its proportionate share of the Trust’s assets will be equal to the cost of acquiring the Shares and the Shareholder’s holding period in such assets will begin on the day following purchase.

Rather than having you wonder “What do I do?” I’ve decided to bring you a sweet little table I found from Charles Schwab on 2015 USA Tax Liability:

Basically, keep tally of your assets. I recommend GNUCash. Here’s what you need to do:

- MAIN VERSION Setup your Books to use ‘Unknown’ or ‘Code for Testing Purposes’ (XXX or XTS), from there, denominate your transactions on the order of milli-bits, or .0001 BTC (explained below) (ALTERNATE VERSION STEP 1: If you absolutely must set your default to USD, setup a ‘Security Asset’ account for Bitcoin (also denominated in millibits). With this alternative method, you can set an exchange rate for your BTC to see the equivalent USD for all transactions automatically. If you do not require on the fly fiat conversions for your bookkeeping activities (you mine Bitcoin or only exchange bitcoin occasionally), then choose the MAIN version)

- Record All transactions (such as mining, such as consulting fees, or service fees for work performed, for sales, expenses, refunds, etc.)

- By using Milli-bits, you can round the change down to the final satoshi. If your business operation involves bank related math such as dividend payments or fractional satoshis, then you may need to consider using a 2ndary test pegged currency to account for those within Gnucash, alternatively and transfer as a back and forth for your dividend disbursement distribution schedules amongst your customers (That’s your first free tip, John)

- Come February, if you have diligently recorded all BTC denominated income (and if you are getting paid good-ol cash, then simply hold it as a foreign asset (USD, JPY, EUR, ETC.), prepare your tax liability reports for your local and federal governments – I’m guessing you’ve either prepaid your tax liability or you’ve got a nice bundle ready to cover your tax bill.

On the Middle of page 68 there is a scary bold paragraph that goes into too much detail and is confusing.

Legislation has been introduced that would change the tax considerations of an investment in bitcoins and in the Shares. Based on this pending legislation, a bitcoin may be treated as currency for U.S. federal income tax purposes, which may produce less favorable U.S. federal income tax consequences than the consequences described above. Accordingly, each Shareholder is urged to consult its tax advisor in determining the tax consequences of investing in Shares in its particular circumstances.

In my honest opinion, the US Government is getting greedy. That is, they would charge the ordinary tax rate on all earned bitcoin because they would view it as a currency, INSTEAD of as a commodity. Perhaps this paragraph in bold serves as a detriment to GBTC shares because if USA treats BTC as a taxable currency, then there is a small opportunity, for Bitcoin users to be able to pay their taxes in BTC – being that I am a member of society who gets paid directly in bitcoin, this would allow me the benefit of paying my taxes direct so I’m very progressive towards being able to pay my taxes in BTC.

Moving forward, on Page 73: SM Systems, Inc. serves as the Trust’s Shareholder Communications Hub. This company acts as an accounts portal for all shareholders to view and verify their balances and is a service provided freely as one of the fees associated with the administration of the Trust.

I’ve noticed that there is an elephant in the room here they share with us: Conflicts of Interest. The bottom line is that many of these Barry Silbert Funded Ventures have come together to all act as consultant service for both other Bitcoin related companies, as well as for the entire operation of the GBTC Trust to run smoothly. Yet there will be a point in time to where it will be ‘fiduciary duty’ to investigate any & all potential future partner & investment venture opportunities further & that employees & companies will may demand increased market rates, fees &/or premiums as a result of increased business efforts. (sev&persands :p ) Barry (well his business entities may), at his (their) own discretion, choose to make business-impacting decisions deemed to increase the bottom line at any of the variously owned (yet supposedly) not related but potentially facing conflicts of interest companies (Bitcoin Investment Trust, Secondmarket Holdings Inc, GrayScale LLC, as well as Tradeblock LLC) can and will charge increased fees – making the holdings vehicle more expensive to maintain based on self-valuation.

The bottom of Page 74 is important, but the key takeaway is: Records of the Sponsor officers’ personal trading accounts will not be available for inspection by Shareholders. I skipped a crucial paragraph before that ended with the previous sentence, but basically it says: The employees of the trust have their own personal bitcoins and may choose to trade in a manner contrary to what the trust is doing and to an extent they can do this as much as they wish. (not really a big deal – I guess, but it’s kind of insider trading if you know him and DO LEARN of WHEN and WHERE the higher level employees would be trading bitcoins to take advantage of their own market information). Looks like on Page 75, we see that as of the disclosure statement, the trust has 5 full-time employees.

Item 10 on the bottom of Page 76, FUN FACT:

The Sponsor utilizes a portion of approximately 17,314 square feet leased by SecondMarket Holdings, Inc. The lease expires on June 30, 2022.

The Trustee has not prepared or verified, and shall not be responsible or liable for, any information, disclosure or other statement in this Disclosure Statement or in any other document issued or delivered in connection with the sale or transfer of the Shares.

Prospective investors who are not willing to consent to the various conflicts of interest described under the section “Conflicts of Interest” and elsewhere should not invest in the Trust. The Sponsor currently intends to raise such disclosures and consent as a defense in any proceeding brought seeking relief based on the existence of such conflicts of interest.

Spoiler Alert:

The currently unregulated and immature nature of the bitcoin market, including clearing, settlement, custody and trading mechanisms, the dependency on information technology to sustain bitcoin continuity, as well a valuation and volume volatility all subject bitcoin to unique risks, of theft, loss, or other misappropriation. Furthermore, these factors also contribute to the significant uncertainty with respect other future viability and value of bitcoin. Our opinion is not qualified in respect of this matter.